Energy in the 2020s: a minority report

By Casey Handmer

This week will see a steady stream of advocacy for nuclear power. Many advocates are well-informed. But nuclear has already lost to solar photovoltaic power.

Arguendo, I concede that nuclear power is significantly less harmful to human health and causes far fewer deaths per kilowatt than any form of fossil fuel energy. Even end-of-life disposal costs and radioactive waste are much less harmful on a per-kWh basis than the waste products of, say, extracting and burning coal. Indeed, coal plants produce more radiation (because of naturally occurring radionuclides in the coal) than nuclear plants—to say nothing of coal’s pollution.

But despite the safety and technical maturity of nuclear power, solar PV power has prevailed. Because it is simple.

In 2020, the world had 880 GW of solar capacity. It had 400 GW of nuclear. It had 14 GWh of grid-connected storage batteries. Our total electricity generating capacity was about 6500 GW. Solar PV plants produced only a third the electricity of nuclear, but their capacity is increasing meteorically. Nuclear’s share has a seen significant decline.

Many think wind and solar are unreliable. They’re wrong. They’re more reliable than any base-load source. Generation is variable and intermittent, but we can predict this with weather forecasting, and the low cost of these sources favors overproduction and curtailment to match demand. Nuclear plants can't ramp production to match diurnal demand variations.

Nuclear’s overall capacity factor, or average output divided by peak output, is about 0.9. For solar PV installations, it’s about 0.15. It’s not just that nuclear is comparable to solar, with just a few hundred GW each. It’s that the grid batteries you need to make solar power useful in the evening are woefully underdeveloped.

Could nuclear power quickly scale to meet all of our electricity requirements? Let’s examine 2020 growth rates:

Nuclear power: 0.3 percent

Solar PV power: 26 percent

Grid storage batteries: 243 percent

That’s not a typo.

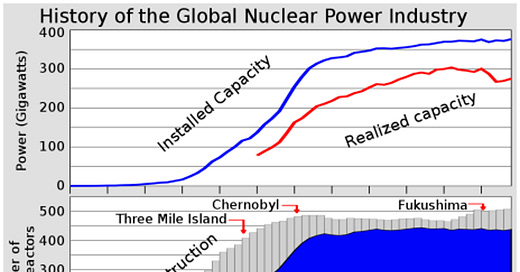

The graph below shows growth in the nuclear industry. Even in the early 1980s, annual growth was only about 7 percent, and since Chernobyl, global investment and deployment has stagnated.

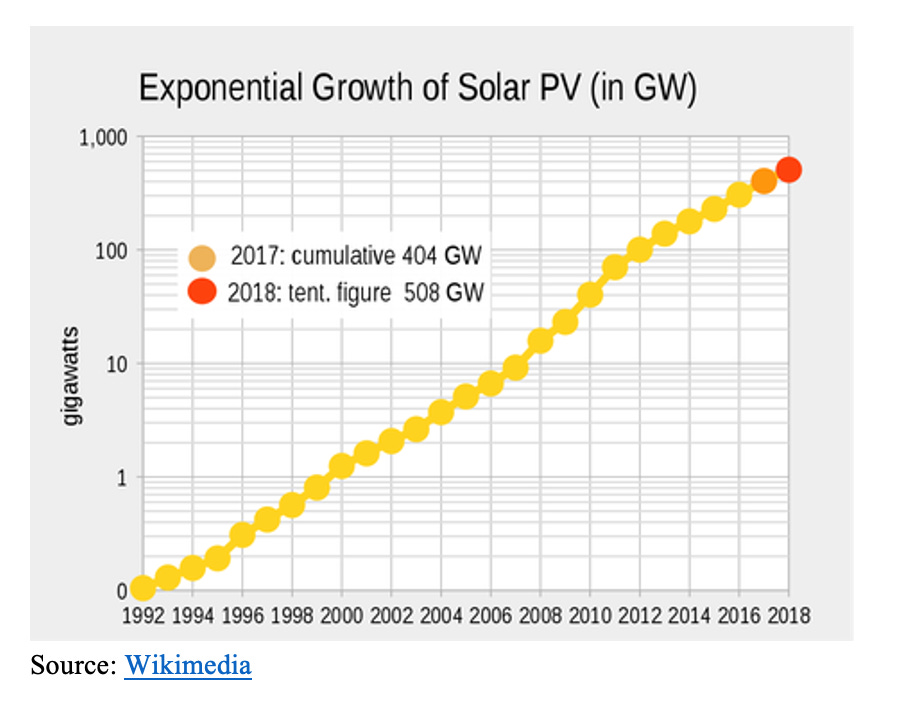

A comparable chart of solar PV growth shows exponential increases over thirty years:

According to Swanson’s Law, solar PV power costs have a 35 percent learning rate: For every doubling of deployment, costs fall 35 percent. Investment and research have compounded this effect in recent years. As deployments grow by 30 percent a year, costs fall by about 10 percent and investment grows by about 20 percent. It’s one of the fastest growing industrial sectors in history.

In 2020, the cheapest bid for utility-scale solar power came in at just 1.35¢/kWh, almost 20 times less than typical retail prices in the West. This trend is accelerating. There is no physical reason for costs to stabilize at their current value. Solar PV panels used at utility scale are already cheaper than drywall. They have no moving parts. Their main ingredient, silicon, is the second most common element in the crust and a major component of sand. Money may not grow on trees, but leaves, which are solar powered, certainly do.

What about batteries? We need them for smartphones, electric vehicles, and to buffer the supply of wind and solar power, stabilizing the grid over periods ranging from minutes to a day. The remarkable chart below shows the way investments in battery production capacity have changed. Not only has battery production skyrocketed—243 percent per year—that growth rate is itself currently growing at 22 percent per year and has yet to stabilize!

People are investing vast sums in battery technology because as the proportion of wind and solar in the grid rises, the need for batteries grows and they become more lucrative to operate. Installed grid-storage batteries outcompete gas peaker plants. Investors have been astonished by the revenues. Tesla’s Horndale Power Reserve battery in South Australia paid for itself within three years, prompting more investment that expanded the facility’s battery storage capacity another 50 percent. No one gets this rich, this fast, in energy—typically.

Can batteries and solar power meet 100 percent of our energy needs? Yes. With our current battery technology of about 100 Wh/kg and $100/kWh, 30 TWh of battery storage for load-shifting would cost US$3 trillion. The global energy market turns over this much every year. New solar power is so much cheaper than old coal plants that savings alone could fund those batteries well before battery manufacturing capacity ramps up to meet demand.

Using 2020 technology, those batteries would weigh 300 million tonnes and fill 15 million twenty-foot cargo containers. A decade-long installation program at 2020 prices would cost about 1.5 percent of global GDP, but save 3 percent because we’d scrap the expensive, mostly coal-fired plants. Building factories regionally would reduce shipping demand. This is why staggering amounts of private capital are flowing into battery manufacturing.

Solar power and batteries are so rapidly outpacing new orders for every other form of electricity generation that nuclear can’t catch up. On the current trajectory, solar power will meet worldwide demand by about 2030. By then, a nuclear power plant we begin building now might be ready to come online.

Why are solar and nuclear on such different trajectories? Is it just a matter of regulatory inefficiency? Or is there a deeper reason? Solar power is competitive because it’s cheap, easy, safe with low-skilled labor, and not a proliferation risk. Nuclear plants today can be made to high standards of safety, but solar power is safe by default—and it’s cheap because it’s simple. It doesn’t require X-ray weld inspection of stainless-steel containment vessels or comprehensive background checks for operators. Just a generic foundation and an electrical plug.

But this neglects the most important reason why solar power is crushing nuclear power. After all, a much simpler and cheaper nuclear plant could be invented tomorrow. The reason solar power and batteries are winning is because the manufacturing technology can be iterated every six months, so the learning curve is much faster. Nuclear power plant technology iterates about every 25 years, or twice in the 50-year life of a nuclear power plant. Many first-generation plants are still operating, but few third-generation plants have been commissioned and fourth-generation plants are still in the planning stage. Even if every nuclear design iteration was ten times better than the last, solar power wins, because solar iterates 50 times faster. It wins with just a five percent improvement per iteration. Is each nuclear design ten times better than its predecessor? Obviously not. Meanwhile, solar PV panels have already been through hundreds of design generations, driving a 10 percent price decrease every year.

Is the decarbonization of the grid important enough that there’s room for both nuclear and solar power? No. Nuclear plants are expensive. The return on investment is measured in decades, at best. The development of ever-cheaper solar power adds unacceptable financing risk to nuclear plant development. The business case for a new nuclear plant would be in serious trouble if wholesale electricity prices dropped even 10 percent. We’re probably within a year of solar developers bidding less than 1¢/kWh. Even in France, lifetime nuclear power costs have never dipped below 39¢/kWh.

There are other reasons to operate nuclear reactors. Small research reactors can produce certain medical isotopes. But for low-carbon power generation, there’s no way nuclear power plant developers will be able to borrow money: Their business case could evaporate before they’re done pouring concrete.

The same goes for geothermal or any other method with greater complexity or higher capital costs than, literally, paving a desert with slabs of glass. This includes wind, save for very windy and cloudy places like the North Sea. The North Sea generated 184 TWh of wind power in 2020. UK oil production over the same period was 380 million barrels, equivalent to about 160 TWh of electricity at 25 percent Carnot efficiency. While the North Sea oil fields are more than a decade into their terminal decline, UK wind farms are set to double in capacity—and this is just projects already underway.

Similarly, the energy produced by a solar farm over its twenty-year lifetime exceeds that generated by even a ten-foot thick seam of coal, even one on the surface. That improbably rich coal seam would produce more energy, at a lower cost, if you used it as the foundation for a solar plant.

Before the industrial revolution, human muscles—powered by plants that capture solar energy—did most of mankind’s mechanical work. This was labor intensive and inefficient, to say the least. Electric motors are four times more efficient than muscles. They can operate without fatigue or metabolic overhead. Similarly, the efficiency of corn in converting solar energy to digestible sugars is less than 0.1 percent. Solar panels are better than 20 percent. The future is so much better than people assume.

Generating 100 percent of our energy from solar panels would consume less than 0.5 percent of Earth’s land. Uninhabited deserts take up 33 percent of the Earth’s land. Agriculture uses 11 percent. Roads and roofs in urban areas are 1 percent. Even if absurdly low solar energy prices caused demand for energy to increase 1,000 percent—enough for every man, woman, and child to fly daily in a supersonic airplane—there would still be plenty of land surface for the panels and no cause for conflict over it. Per capita, the minerals we’d need to make all these panels and batteries would be a bit less than we now use to make cars.

Contrary to dire warnings by poorly-informed merchants of fear, solar power and electric cars are cheaper than fossil fuels and internal combustion precisely because they consume significantly fewer scarce materials—even ignoring the unpriced cost of atmospheric CO2 pollution. In the spirit of full disclosure, I’ve been long TSLA since 2011. There’s a reason: Tesla’s market cap has increased by about 350 since then. Tesla’s production has doubled roughly every year despite an utterly stagnant market for traditional cars precisely because battery electric vehicle technology is much more compelling than traditional internal combustion.

The really interesting part is what happens next. What do we do with energy that is predictably and rapidly getting cheaper, for the first time since 1970? In the US, fracking has produced a glut of cheap natural gas. Even at prices as low as US$2 per thousand cubic feet, gas electricity costs at least 6.5¢/kWh, more than five times more than solar in sunny places. The price of natural gas is set by the amortization of fixed costs in drilling, extraction, storage, transportation, and combustion. The process of converting the chemical energy of gas to electrical energy is about 30 percent efficient. The rest is wasted as heat.

As of 2020, solar energy was so cheap—even excluding curtailment—that you could synthesize hydrocarbons from captured CO2 for about as much as it costs to drill and refine. Prometheus Fuels, among many others, is rapidly commercializing the generation of gasoline and natural gas from electricity, rather than the other way around. This will keep driving explosive growth in solar, even as grid demand saturates later this decade. Carbon-neutral synthetic fuels will soon be cheaper, and more widely available, than fossil hydrocarbons. Good news for aviation. Good news for oil- importing nations in the sun. Too bad for Finland. This is the only politically and economically credible way to build the carbon capture infrastructure we need to avoid climate catastrophe. But the implications of these developments on geopolitics have yet to be understood.

Solar power will be so cheap, and often overproduced, that electricity grids will develop away from the historically large grids we’ve needed to smooth out demand and buffer supply. If electricity is ten times cheaper, utilities won’t be able to subsidize poorly utilized and rapidly depreciating long-distance connection infrastructure. Local generation and storage will ramp up in concert with steadily decreasing costs. The future of electricity is local.

What else might we do with stupendously cheap electricity? Thermodynamically intensive devices such as heat pumps and electrochemical devices such as smelting aluminium or magnesium will recycle everything. By reverse-osmosis, they will desalinate enough water to refill rivers parched by global warming. They will power air conditioning, data center cooling, antimatter synthesis, and zero-impact mining using hard rock tunnel boring machines far beneath the surface.

What does energy look like in 2040? Post-scarcity, almost too cheap to meter. Containerized batteries and solar panels proliferate. Clean air. Cheap, fast air transport. Quick, quiet, and largely automated surface vehicles. Continuing economic growth.

Long live the sun, let the darkness disappear!

Casey Handmer is a physicist who completed his PhD in gravitational waves at Caltech in 2015. He was the Hyperloop levitation engineer and currently writes software at NASA JPL. He writes on a variety of science and technology topics at blog.caseyhandmer.com and his views are his own.

Well I can hardly wait. Really. Having said that, it has been my (albeit limited) experience with solar that it over promises but underperforms. From purchasing a solar powered phone recharger to roof top solar panels to powering up batteries on a sailing vessel at sea. It seems that the fossil fuel portable generator is still a must have.

I'll believe it when I see it. The Germans bet big on this ten years ago, and they ended up burning more coal. Ditto for the Chinese. Energy policy is serious business.