I was just about to finish working for the day, send out a post titled “Israel’s Third Lebanon War has begun,” and go to bed. But I checked the news and discovered Iran had just launched a massive salvo of ballistic missiles—181 in total—at Israel. Most were intercepted (by Israel, the US, and Jordan). But a Palestinian was killed and two Israelis were hurt. The attack sent ten million people running for bomb shelters while interceptors exploded in the sky.

Shortly after the strikes, Iran’s Revolutionary Guard released a statement claiming the attack was in retaliation for the “martyrdom” of Haniyeh, Nasrallah, and the Iranian Quds Force commander in Lebanon, Abbas Nilforoushan. It said that “if the Zionist regime responds to the Iranian attack, it will face violent assaults.”

Iran made a “big mistake tonight,” Netanyahu said. “And it will pay for it. … The regime in Iran does not understand our determination to defend ourselves and our determination to retaliate against our enemies. Sinwar and Deif did not understand this, Nasrallah and Shukr did not understand this, and there are probably those in Tehran who do not understand this. They will understand: Whoever attacks us—we will attack him.”

It’s clear that this time, Israel is not going to “take the win.”

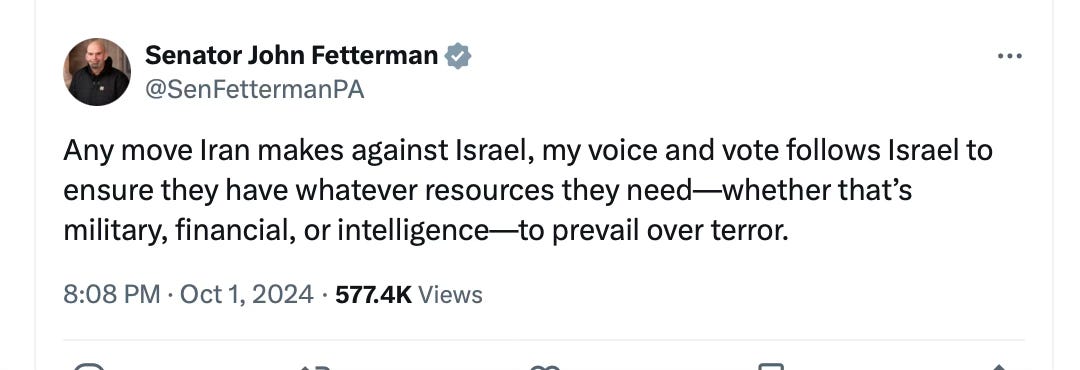

Nor does it seem we’ll be urging them to. Jake Sullivan said the Biden administration has “made clear that there will be consequences—severe consequences—for this attack” by Iran, and the US “will work with Israel to make that the case.” (Biden must be surprised that Iran isn’t as keen to get back in that nuclear deal as he’d hoped.) Biden said the US was “fully, fully, fully supportive of Israel,” and pledged “ironclad” support.

Iran’s new president, Masoud Pezeshkian, said the attack was a “decisive response” to Israel’s “aggressions.” “Let Netanyahu know that Iran does not seek war, but it stands firmly against any threat. Do not enter into a conflict with Iran.”

Israel “proved its defense capabilites, we’ll strike back”—IDF chief

US calls on every nation to join it in condemning Iran’s attack on Israel

US Navy shoots down Iranian missiles, Jordan allows use of airspace

Israel’s foreign minister reports incident in Sweden embassy, police probe

Germany condemns Iranian missile attack on Israel, urges immediate halt

Lebanon’s airspace closed for two hours, transport minister says

Khamenei remains in secure location after missiles fired at Israel

“We should strike Khamenei.” Senior Israeli official calls for action against Iranian leadership:

A senior Israeli security official has urged Israel to take decisive action against Iran’s leadership, including Supreme Leader Ali Khamenei, following the latest missile attack on Israel. “We should expect to strike government centers and possibly eliminate figures like Khamenei,” the official told The Jerusalem Post on Tuesday, calling for a targeted response that includes Iran’s military infrastructure and aircraft. …

The senior security official emphasized that Israel’s response must be strategic and swift. According to the official, Iran’s Supreme Leader is not only behind the recent attacks but also seeking to further destabilize the region by pursuing nuclear capabilities. “Khamenei wants a conventional attack and is seeking backing for nuclear weapons. Israel must destroy Iran’s nuclear sites now,” the official said. The official laid out three critical objectives for Israel’s counter-strike, with the primary goal being to weaken the Iranian regime itself. “We need to go beyond military sites and strike at the heart of the regime," the official said, adding that eliminating figures such as Khamenei would deliver a strong message to Tehran and its allies. The official also called for targeting Iran's economic infrastructure as part of the response. “After neutralizing their nuclear capabilities, we must go after Iran’s economy—oil, gas, communications, and banking,” the official said. “This will demonstrate that Iran cannot act with impunity.” The final element of the proposed response involves crippling Iran’s military infrastructure. “We should down some of their planes—although they don’t have many—and destroy missile production facilities,” the official added.

Sounds good to me.

IDF vows “powerful airstrikes throughout Middle East.”

Senior Israeli officials vowed Tuesday evening that Jerusalem will not remain silent following Iran’s large-scale missile attack. A defense official promised a “severe response,” while another Israeli official warned, “What Iran has suffered so far is only a fraction of what it will face now.” … A high-ranking government official added, “Israel has full legitimacy for an unprecedented strike on Iranian soil—this is the time to strike at the head of the Iranian snake.”

Sounds good to me.

★ Israel could produce a measured response — or risk World War III:

Given the scale of the Iranian provocation, Israel now faces three possible courses of action:

A pro forma response: In this scenario, Israel would respond to Iran’s ballistic missile strike, but only symbolically. Its calculation in taking this path would factor in that no Israeli lives were lost in this strike, and that Iran telegraphed the attack with warnings to Russia and the US.

A limited, low-risk response might satisfy some of Israel’s immediate security concerns, but it would do little to deter Iran or disrupt its larger strategic ambitions. This is the path of least resistance, but it is unlikely to alter the status quo. For Israel, that might not be enough anymore.

A tactical strike on Iran: A more substantial response could involve direct military action against Iranian assets, such as oil facilities or military installations. This would aim to inflict real damage on Iran’s infrastructure, forcing it to reconsider further provocations.

An attack on an oil installation, for instance, could disrupt Iran’s economic lifelines and send the clear message that Israel will not tolerate continued missile strikes. The goal here would be to create enough pain for Iran to deter future actions, without pushing the region into a full-scale war.

A strategic overhaul of the region’s balance of power: The third option is far more ambitious, and fraught with risk, but could reshape the Middle East. It would involve Israel somehow pushing the West to lay down the law with Iran, demanding not just an end to its missile strikes, but a full dismantling of its nuclear program and an end to its sponsorship of proxy forces across the region.

★ The threat of all-out Middle East war looms: two scenarios:

[I]t is not only what happens in the next few days and weeks that has the Biden administration on high alert. The President’s national security team is also now looking ahead to the dangerous months after the 2024 election—the roughly 90-day period between the election on November 4 and the inauguration of America’s next president on January 20, 2025. It is in this ‘lame duck’ interval—when a presidential successor has been chosen but not yet sworn into office and the incumbent president’s power is at its lowest ebb—that the White House is desperately worried about the outbreak of a ‘lame duck war.’

Biden’s team has grown increasingly concerned that Iran (patron of Hezbollah and nearly all of Israel’s enemies) may seize on this period to blow off international restraints and race to build a nuclear weapon. President Trump, too, has raised concerns over an Iranian nuclear breakout in the waning days of Biden’s term, according to my sources.

If Iran does make a break for the bomb, America, Israel and the West will be forced to decide whether to preemptively strike Tehran or standby while the Islamic Republic becomes a nuclear-armed menace. Biden is taking this threat extremely seriously.

… Israel may see little choice but to strike at Iran’s nuclear weapons program and take out Tehran’s senior leadership and economic assets. Such a conflagration would make their crippling decapitation strikes against Hezbollah in Lebanon and the destruction of Hamas’s terror and governance capabilities look tame by comparison.

The second scenario for this lame-duck period at the end of Biden’s term is equally fraught. If Donald Trump wins the election, Iran’s ayatollahs may decide it is now time for them to race towards a nuclear bomb—and, according to US and Israeli intelligence, Tehran is just a turn of the screw from that goal.

… If Khamenei dashes for the bomb and Biden doesn’t act, Trump or Harris could take office with radical mullahs in possession of the world’s most dangerous weapons. Khamenei then will be well on his way to realizing his genocidal ambitions.

“This was a brazen, unacceptable attack by Iran and every nation in the world must join us in condemning it … our support for Israel’s security is ironclad, we will continue to stand with the people of Israel in this critical moment … what you saw was Iran launching a state on state attack to protect and defend the terrorist groups that it has built, nurtures, and controls … of course there must be consequences for Iran for this attack … Iran has been a destabilizing force going back years … What we will do is to continue to hold them accountable.”

I recommend the whole thing. Scroll to 55:00, where it begins.

Meanwhile in Lebanon, the third Lebanon war has begun.

Israel sends ground forces into south Lebanon to attack Hezbollah sites near border:

Israel launched limited ground raids into southern Lebanon late on Monday night against Hezbollah forces and infrastructure positioned along Israel’s northern border, hours after the security cabinet approved plans for the newest phase of the war against the Lebanese terror group, in a move that the US appeared to warily support. Announcing the incursion in the early hours of Tuesday morning, the IDF said that “limited, localized, and targeted ground raids” had begun several hours earlier.

Ground troops operating inside southern Lebanon were being assisted by air and artillery forces, the military said, adding that the operation was based on plans drawn up by the IDF’s General Staff and Northern Command. The IDF’s formal confirmation that Israeli troops were operating in Lebanon came several hours after various conflicting reports emerged on social media and in some Arabic media outlets as to whether some troops had already crossed the border. Lebanese troops had further added to speculation when they pulled back about five kilometers (three miles) from positions along the border late on Monday, apparently opting to stay on the sidelines, as they have done historically in major conflicts with Israel.

US backs “limited operation” in Lebanon. US Defense Secretary says he agrees on the need to “dismantle attack infrastructure along the border” so Hezbollah can’t mount “October 7-style attacks” on the north.

IDF: Hezbollah was ready to invade en masse after October 7:

The Israel Defense Forces revealed Tuesday that even before it officially launched ground operations in southern Lebanon earlier in the day, its troops had conducted dozens of secret cross-border raids throughout the current war, destroying numerous Hezbollah positions, tunnels and sites. The army also disclosed that days after Hamas’s October 7 mass onslaught in southern Israel, thousands of terrorists had been positioned near the Lebanon border in a plan to storm the Galilee and unleash similar carnage there.

Hezbollah’s deputy leader Naim Qassem, sweating, said the group is ready to face an IDF ground op. It was the first speech by a Hezbollah official since Israel killed Nasrallah:

“Despite the losses of its commanders, the attacks against civilians throughout Lebanon, and great sacrifices, we will not budge from our position,” Qassem said in a speech from an undisclosed location in Beirut. “We will continue to support Gaza and to defend Lebanon.” Qassem, who appeared to be sweating profusely throughout his speech, asserted that Hezbollah will continue in the footsteps of Nasrallah, who led it since 1992. He said the terror group is continuing its operations, working according to plans already laid out, and described its attacks on Israel thus far as the “minimum.” He added that while the battle could be long, Hezbollah is confident that Israel will not achieve its aims.

Qassem eulogized Nasrallah for his leadership, and his popularity with the masses, and said that Hezbollah has already proven its determination to continue fighting, by firing rockets on Haifa and on the West Bank settlement of Maale Adumim, an attack that the terror group had previously not claimed and that according to Qassem, sent a million people into bomb shelters.

I’d be sweating too, if I were him.

Ground maneuver in Lebanon: Israel’s decision will likely depend on three factors: the level of damage inflicted on Hezbollah, the toll on Israeli soldiers' lives, and the potential for a prolonged engagement in Lebanon:

After weeks of operational success, the Israeli military wants to take advantage of Hezbollah's weakened state and deepen its gains along the border. The aim is to dismantle Hezbollah's operational infrastructure, including tunnels built for infiltrations and attacks, as well as houses and areas used to hide weapons and terrorists. Clearing these threats is vital to reduce the danger to Israeli communities and ensure displaced residents can safely return home. …

The IDF is weighing three main options. The first is a limited maneuver near the border to destroy key Hezbollah infrastructure. This targeted operation would be confined in scope and time and could be wrapped up in weeks. The second option involves advancing up to the Litani River to hit infrastructure further from the border. The third option would take Israeli forces north of the Litani to inflict deeper damage on Hezbollah's capabilities and personnel.

And in Israel, six people were killed and nine were wounded in a terrorist attack in Tel Aviv, one of the deadliest in recent years:

Two terrorists, one of whom was armed with a rifle and the other with a knife, attacked civilians on the Tel Aviv light rail before getting off and continuing on foot and shooting and stabbing people on Jerusalem Street in the city. A municipal security officer and armed civilians shot and “neutralized” the two terrorists, police added. The two attackers were identified as Mehmed Khalaf Saher Rajab and Hassan Mohammed Hassan Tamimi, both Palestinian residents of Hebron in the West Bank.

An article that caught my eye:

Israel is now perceived as a country with perhaps mythical powers, and the ensuing uncertainty and speculation as to what else might be in store for its enemies is a decisive strategic force multiplier:

…. In a statement released September 24, Hezbollah’s media department said Israeli planes have dropped leaflets in the Bekaa Valley. It said “Please do not open or share the QR codes; they should be disposed of immediately as they are very dangerous. This code can extract all the information on your devices and poses a threat to your safety. We urge everyone to exercise caution.”

In the wake of the Israeli show of deadly technological wizardry, Islamists vow to destroy Israel, as Iran’s Ayatollah Khameini had just urged, which sounds even more hollow than before. In contrast, the self-confidence and morale of Israelis have received a material boost. It may be even argued, that Hezbollah’s senseless and counterproductive aggression paradoxically provides Israel with successive opportunities to demonstrate its unequaled superiority over its enemies.

Okay, now I’m really going to pack it in and get some sleep, because at this rate, tomorrow will be a long day.

A Spring 2024 World Bank report has pointed out that the Iranian economy is in bad shape. It points out:

1. "In 2023-24, only 73 percent of budgeted revenues are estimated to have been collected, primarily since only 55 percent of the planned oil revenues are estimated to have materialized." (The Iranian financial year is from March 21 to March 20. Other sources say that Iranian oil and gas fields are in terrible shape. They need big investment to upgrade and refurbish them, but there's no investment coming in. Even though Iran ranks among the top countries with hydrocarbon reserves, esp. natural gas, it's importing gas from Russia and Turkmenistan and it's had payment problems with Turkmenistan of late. Oil and gas contribute to nearly 50 percent of Iran's GDP.)

2. "GDP growth is forecast to moderate to an annual average of 2.8 percent during 2024-25 to 2026-27."

3. "The growing concentration of trade with limited trading partners such as China, exposes the economy to fluctuations in these partners’ economic prospects." (Other sources point out that nearyl 90 percent of Iranian oil is bought by China.)

4. World Bank scenario simulations indicate "an expansion of the conflict in the Middle East, that would directly involve Iran, suggest it could lead to a 7 percent GDP contraction with significant impact on fiscal and external balances, even if the shock is limited in scope and restricted to 2024-25".

5. Sources also indicate considerable unrest over economic issues like inflation (now at around 30 percent), frequent unpaid wages in the oil sector, unpaid pensions, which now can't cope with the inflation, unfinished housing projects, etc.. There have been protests across the country from the oil-dominated southwest to central Iran, and even in Tehran where pensioners protested in August outside the oil ministry.

Investment from Russia in 2023 was just $2.76 billion, while direct investment from China was just $131 million. China has promised much but delivered little real investment. Beijing has to balance between Iran and the other GCC states like Saudi Arabia and the UAE where the geo-economic stakes are way bigger. Besides China, the other big trading partners are some of the Central Asian states and the OIC, and the last two can't move the trade earnings needle enough to boost the economy. They're also constrained by US sanctions.

The fact is the Iranian economy is in no shape to withstand a war. But one must also note that an all out war could destabilize the global economy. Oil and gas from Qatar, Oman, Saudi Arabia, the UAE could be severely affected; oil prices, which are declining at the moment, could rise again. Trade through the Gulf of Oman could be hit, unless the US secures it, which it well might to strangle Iran. Far too many balls in the air, right now.

Great column.

One quibble:

"...Biden is taking this threat extremely seriously..."

Do you really think that Biden is capable of taking anything (except for ice cream) seriously?